For taxpayers who are filing their tax return for the first time they need to apply for e-Pin before tax filing. To download ITR-V click on the Download Form button of the relevant assessment year.

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

Another taxpayer Siti Rasidah Aziz 47 from Ulu Kelang said she would file in hers by today.

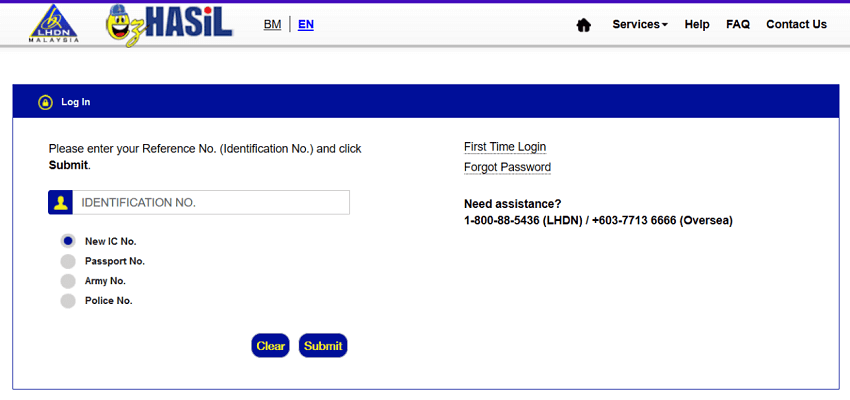

. Deadline for Form B resident individuals who carry out a business is 30 June 2022 manual filing and 15 July 2022 e. TARIKH TAMAT E FILING LHDN 2022. Key in your Identification Number NRIC and click Forgot Password.

Taken directly from the LHDN website it is cited that referring to Section 831A Income Tax Act 1967 that every. Reset the e-Filing password via the registered email address. LEMBAGA HASIL DALAM NEGERI MALAYSIA HASiL ANJUR PERSIDANGAN PERCUKAIAN KEBANGSAAN 2022 KALI KE-22.

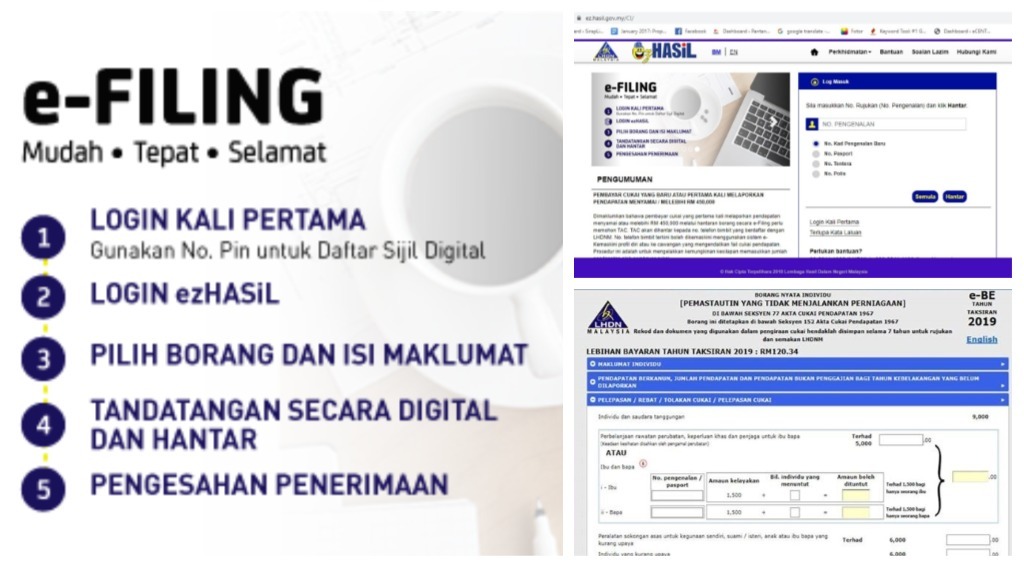

Pengesahan ini boleh didapati melalui perkhidmatan ezHASiL di httpsezhasilgovmy atau di cawangan-cawangan LHDNM. Dimaklumkan bahawa pembayar cukai yang pertama kali. Internet Explorer 110 Microsoft Edge Mozilla Firefox 440 Google Chrome 460 atau Safari 5.

Ibu Pejabat Lembaga Hasil Dalam Negeri Malaysia. Tarikh akhir pengemukaan Borang BE Tahun Taksiran 2021 adalah 30 April 2022. 95 Understanding Tax Relief.

May 15 deadline to submit tax returns via e. Jika kamu belum menemukan Info yang dicari silahkan tulis komentar dan jika artikel ini berfaedah. 91 Starting an application.

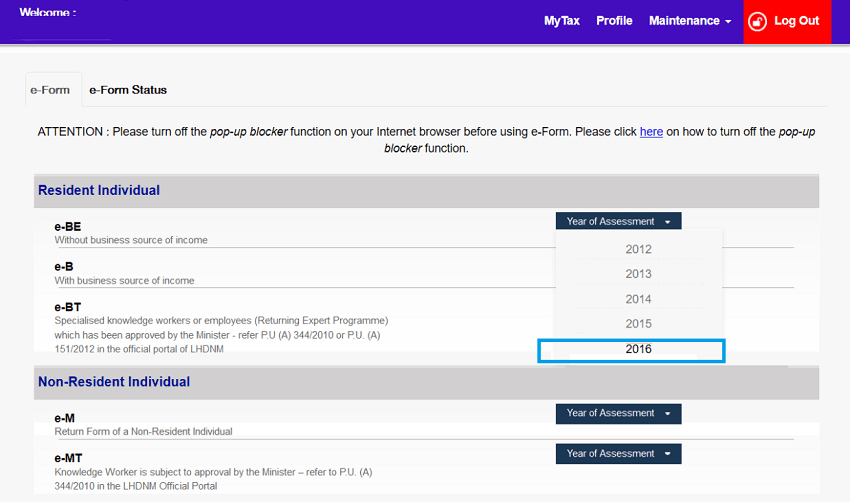

8 Using LHDN e-filing to file your ITRFs. Go to the income tax India website at wwwincometaxgovin and log in. 91 Starting an application.

Microsoft Windows 81 service pack terkini Linux atau Macintosh. Employer company and Labuan company is compulsory to submit Form E via e-Filing e-E with effect from remuneration for the year 2016. Select the e-FileIncome Tax ReturnsView Filed Returns option to see e-filed tax returns.

BNCP dan borang anggaran yang disediakan dalam e-Filing adalah seperti berikut. For Year Assessment 2021 via e-Filing. 93 Starting the e-filing process.

9 Steps to follow in e-filing. 95 Understanding Tax Relief. These are the steps to reset the e-Filing password via LHDN registered email address.

Melayu Malaysia MYTAX Content. 97 Declaring sending and signing. Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022.

Aplikasi e-Filing adalah merupakan sistem yang membolehkan pembayar cukai membuat pengisian dan menghantar Borang Nyata Cukai Pendapatan BNCP dan borang anggaran secara dalam talian. Bagi kegagalan mengemukakan BN dalam tempoh yang dibenarkan tindakan berikut boleh diambil berdasarkan tarikh akhir pengemukaan BN berkenaan-. 96 Checking your summary.

BN selain Borang E dan Borang P. Key in the 16-digit PIN number in the First Time Login menu via MyTax. PIN number will only be processed if application is complete with supporting documentation.

Meanwhile LHDN stated that as of March 31 2022 the total number of TRFs for Assessment Year 2021 received through manual and e-Filing submissions for non-business taxpayers was 1163444. The deadline for filing income tax in Malaysia also varies according to the type of form you are filing. 9 Steps to follow in LHDN E-Filing.

8 Using LHDN E-Filing to file your ITRFs. 3Submit return form of employer Form E together with the CP8D on or before 31 March of the following year. Itulah pembahasan perihal Cara Isi Borang e-Filing Cukai Pendapatan Individu Borang BE B 2020 yang telah admin rangkum berasal dari bermacam sumber.

Visit the LHDN website. 96 Checking your summary. Sehubungan itu keseluruhan rangkaian sistem LHDNM meliputi EzHasil Bantuan Sara Hidup dan Bantuan Prihatin Nasional akan ditutup bagi tujuan penyelenggaran seperti berikut.

For the BE form resident individuals who do not carry out a business the deadline is 30 April 2022 manual submissions and May 15 2022 via e-Filing. Borang eab prima borang b income tax e filing lhdn cara isi efiling. Ada Punca Pendapatan PerniagaanPekerja Berpengetahuan atau.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference. How to use LHDN E-filing platform to file E form Borang E to LHDN ALL employers Sdn Bhd berhad sole proprietor partnership are mandatory to submit Employer Return Form also known as Borang E E form via e-Filing for the Year of Remuneration 2021 in accordance with subsection 83 1B of the Income Tax Act ITA 1967. Via the LHDN website you will be able to download your past tax returns and update your personalbank account information to the LHDN.

Personal income tax filing starting from 01032022. 94 Updating personal and income details. CP55D e-Filing PIN Number Application Form for Individual.

KTP Company PLT AF1308 LLP0002159-LCAWisma KTP 53 53-01 53-02 Jalan Molek 18 Taman Molek 81100 Johor Bahru Johor Malaysia T 6 07 361 3443. E filing lhdn malaysia. E - Janji Temu.

The Forgot Password link on the LHDN website. Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference 2022 NTC 2022 secara bersemuka serta dalam talian menerusi platform aplikasi Zoom. Under Select Reset Medium choose the option.

94 Updating personal and income details. The reason you need this is to ensure that if you are above the paygrade that requires you to pay taxes the form ensures that you are aware of this and this is the form you use when you go online and do your E-Filing. 93 Starting the e-filing process.

Adalah dimaklumkan bahawa Lembaga Hasil Dalam Negeri Malaysia LHDNM akan menaik taraf sistem atas talian bagi membolehkan akses berterusan ke semua sistem LHDNM. 71 Total income Tax exemptions Taxable income. The ITR-V will be downloaded.

Form E will only be considered complete if CP8D is submitted within the stipulated deadline.

Ctos Lhdn E Filing Guide For Clueless Employees

Guide To Using Lhdn E Filing To File Your Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

How To File Income Tax In Malaysia Using Lhdn E Filing Otosection

E Filing Lhdn 2022 Cara Daftar Isi Buat Login Kerajaan Online

Lhdn E Filing For Clueless Employees In Malaysia Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

How To Reset Lhdn E Filing Password The Money Magnet

How To Reset Lhdn E Filing Password The Money Magnet

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Ctos Lhdn E Filing Guide For Clueless Employees

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Guide To E Filing Income Tax Malaysia Lhdn Otosection